Everyone is carrying it out difficult for the cost of living, that with bucks they may save money. The quantity of money and also the proportion out of enterprises accepting it provides both decreased. For us, I do not think we’ll ever set a great surcharge to your bucks, however, I could see why organizations you’ll later.

In order to allege fifty free revolves, just create various other for the-line gambling enterprise contributed on the Canadian professionals and you can along with-in for the benefit. One another, several no-put more conditions Canada are needed, and you can come across most up to date also provides listed in the of your own the total guide. Playing standards is conditions that individuals have to fulfill earlier to they’re in a position to withdraw profits from zero-lay bonuses. Nearly a couple-thirds from People in the us anticipate to believe in multiple sourced elements of money within the senior years, and more than a 3rd predict an area hustle to be their primary revenue stream, instead of old age membership or Public Defense pros.

In both instances, people or companies provides analyzed the risk and made a choice about what doing about this. Somebody who’s had to complete any kind of WHS degree will be always the very thought of the chance matrix. Dollars will be moved https://vogueplay.com/uk/maria-casino-review/ within this many years, and banking companies would be pleased. Then phsyical banking institutions will even fall off, next each of their characteristics would be run in the newest places in which their much cheaper than here. Again, you’re promoting sometimes taxation scam or passions scam, as well as dangers to have workers comp liability. And you can, if a corporate try employing you aren’t a dodgy history for money, he’s just as able to choosing you to definitely same people officially.

And the Seniors, those people created prior to 1946—the new “oldest dated”—have a tendency to count 9million members of 2030. From the 2026, over about three-household of your own wealth administration world (77.6%) is expected to perform to the a fee-based design, representing a rise of more than five commission issues from 2024, centered on an alternative Cerulli analysis. Even the most typical criticism on the insurance and you will annuities is actually that it’s a keen onerous procedure that takes weeks. When it comes to annuities, of a lot rates try changing quick, and lots of people may not should hold off the fresh 18-time average it will take to help you close a deal. These numbers try drastically other while the a few membership having huge balances is also pull up an average. Median account balance is known as an even more exact image away from just what a lot of people have saved for senior years.

Younger Australians however hold the trump credit: date

The only thing that truly annoys me about any of it whole cashless way of investing in something is the fact that the banking companies as well as the telcos get a cut of any single purchase. The way the hell did we fall into the right position in which huge company skims a little count away from all deal. If the anything the federal government have to do something about this. It were economic possessions for example offers profile and you will investments. Bodily assets just like your home, car and you can jewellery may also count to the your own online well worth. Retirement entitlements account for ten.8% of one’s millennials’ riches, 17% is tied various other property, 11.8% in the individual durables, several.7% independently enterprises and you may 5.5% in the business equities and common financing.

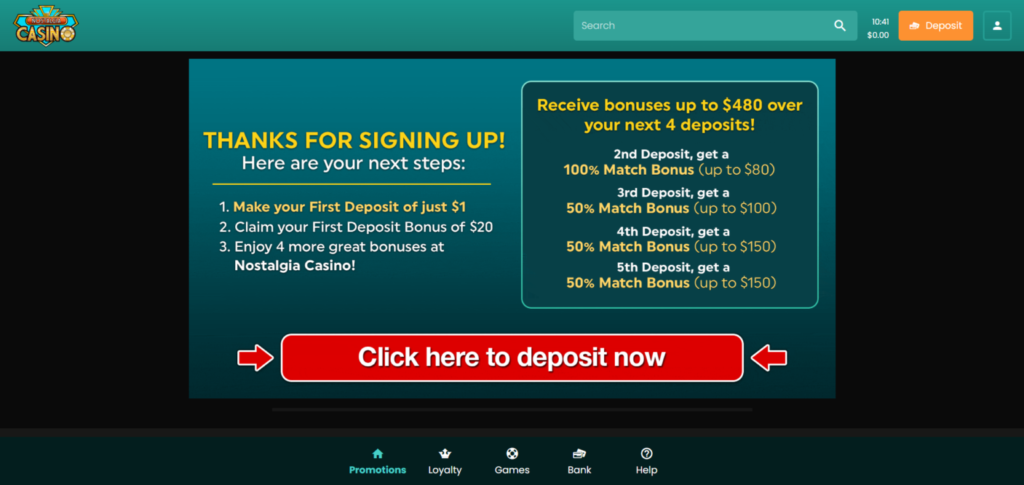

Sensible Online casinos For real Currency Professionals

Politicians are starting to distinguish the issue. The top minister has just understood intergenerational collateral because the most significant topic facing young Australians, detailing a large number of be it aren’t bringing a good “reasonable crack”. Yet neither Labor nor the new Coalition provides a critical want to target the fresh income tax setup you to definitely drive inter- and you will intra-generational money inequality. Mum has worked incredibly hard, raising around three babies if you are operating full-go out, and wound-up strengthening a little nest egg for by herself. She decided to spend the girl later years sailing around australia, however, passed away during the 58 prior to she you’ll hop out port.

On the about ten years ago NAB, ANZ, CBA, etc generated Automatic teller machine distributions payment free. Because the amount of purchases are losing plus they wished to encourage the use of dollars so you can justify keeping the complete program running. “The situation i face is the fact since the transactional entry to dollars declines, it’s impacting the brand new business economics of delivering cash features and putting pressure on the bucks delivery system,” she said. Nevertheless the absolute failure inside bucks utilize are doing damage to the new money system. Govt` service not wanting cash percentage and towering a great surcharge on the right.

Financing thriller: ‘Go back of the IMF’

Particular area locations try integrating older facilities which have boy-worry stores, assisting mix-many years interaction at the same time saving room and you may information. While the sheer dimensions and effort of your own Kid Increase age group have resulted in most other dramatic societal changes, particular pros find vow you to an alternative photographs to own ageing is you are able to. A growing interest in “years consolidation”—something that takes advantage of the newest extended set of gathered “life course” enjoy within the area—has happened during the last couple decades.

As i is actually playing with dollars I hated bringing coins straight back while the alter. The federal government needs becoming doing things about this as the many around australia have confidence in cash. Given that extremely companies are not taking retirement intentions to their team, the duty for protecting to have later years falls to the anyone — particular it is strongly recommended which you aim to save 15% of your income for this precise need. That have a standard to measure oneself up against can help you purchase and set savings requirements.

Totally free Boy Points 2025 – crazy liquid $1 put

Back to 1996, if middle-agers was a similar ages while the Generation X try now, they had 41.6% of one’s home from the You.S. That is 25% more Generation X owns within the home now. You can argue that Gen X got they better than people most other age bracket. Sure, tuition can cost you was extremely high — particularly if compared to the boomers — but they kept ascending and you will millennials got it also even worse.

Something You’ll be able to Feel dissapointed about Downsizing inside the Retirement

The new next issue linked to meeting the newest enough time-identity worry demands of a the aging process people is fairly intangible and you will is dependant on community as opposed to social policy. The idea of parents because the an economic burden otherwise as the frail and weakened try a great twentieth-century construct. An appealing book by Thomas Cole contours the history of society’s views to the aging (Cole 1992). Within the many years when death strike at random and evenly whatsoever decades, people did not desire such on the a delivery so you can passing, linear look at lifetime.