The Consumer Price Index (CPI) data for February, set to be released on March 12, offers a vital measure of inflation. This knowledge is pivotal for economic coverage and funding strategies, as it influences the Federal Reserve’s decisions on rates of interest. This chart exhibits the annualized and average daily value volatility of chosen cryptocurrencies in 2021. Common errors include overtrading, emotional decision-making, and neglecting risk management.

- Standard Deviation, the bedrock of volatility measurement, quantifies how much cryptocurrency costs deviate from their average.

- In the ever-evolving world of finance, cryptocurrency has emerged as a game-changer.

- Additionally, macroeconomic developments and financial instability in conventional markets spill over into the crypto area, profoundly impacting prices.

- At the very least, it’s likely that extra mainstream adoption of the premier cryptocurrency will lower its volatility.

- This restricted liquidity amplifies the potential for sudden price swings, which might occur in each upward and downward directions.

This can lead to increased regulatory scrutiny and potential changes in legal guidelines and laws affecting cryptocurrencies. These changes can further influence the volatility and total stability of the crypto market. As the calendar flips to March, the crypto market is on the purpose of dealing with doubtlessly pivotal modifications. Standard Deviation, the bedrock of volatility measurement, quantifies how much cryptocurrency prices deviate from their common. With this indicator, merchants can assess volatility and identify potential trend reversal factors in the market. Technological developments within the blockchain and cryptocurrency can stabilize and destabilize costs.

Managing Crypto Volatility

Equally important is to place collectively a portfolio measurement you could actively manage successfully. A lot of novice buyers over extend too soon, creating a portfolio that spans tens of crypto assets if not more. When the markets exhibit sudden changes, it can be tough to watch all of cryptocurrency volatility index your investments directly, not to mention act and mitigate danger. Advances in blockchain expertise and the development of latest cryptocurrencies could affect future volatility. For instance, enhancements that increase the scalability and efficiency of cryptocurrencies may enhance their adoption and reduce volatility.

First, the crypto market remains to be comparatively younger and less liquid in comparability with conventional financial markets, resulting in extra significant worth swings. Second, the worth of cryptocurrencies is essentially primarily based on speculative trading, which can cause rapid value adjustments. Third, news and occasions, similar to regulatory updates or technological advancements, can have a considerable impact on crypto prices. Lastly, the decentralized nature of cryptocurrencies means they https://www.xcritical.com/ are much less subject to authorities monetary insurance policies, which may lead to elevated volatility. Understanding cryptocurrency market trends and the affect of global events is significant for members in the crypto space. Armed with this information, people can make informed choices, implement efficient risk administration methods, and navigate the twists and turns of crypto volatility confidently.

Mastering The Art Of Cryptocurrency Buying And Selling

The Federal Reserve’s stance on rates of interest, highlighted by Chair Jerome Powell’s remarks, is a barometer for economic coverage path. Interest fee selections affect borrowing costs and sway investor sentiment towards danger assets, together with cryptocurrencies. Volatility in cryptocurrency creates a high-stakes enviornment, providing engaging profits while bearing the risk of considerable losses.

Many of the explanations for price volatility in mainstream markets hold true for cryptocurrencies as well. News developments and speculation are answerable for fueling value swings in crypto and mainstream markets alike. Heightened volatility and a scarcity of liquidity can create a harmful mixture because both feed off of each other. Other than bitcoin, most different cryptocurrencies additionally lack established and extensively adopted derivatives markets. Under the sway of day merchants and speculators, crypto prices typically exhibit healthy volatility of the sort we see in mainstream markets.

If you want to commerce cryptocurrencies it’s to your advantage to learn all you could about blockchain expertise and the crypto business, including its dangers. Whether crypto volatility will eventually mimic volatility patterns present in mainstream property remains to be to be decided. But, as the asset class continues to develop and develop, it’ll probably continue to often exhibit outsized volatility till it reaches full maturity sooner or later sooner or later. Dollar-cost averaging technique involves buying a set quantity of a specific asset on an everyday schedule, no matter its price. Over time, this will reduce the impression of volatility on the general cost of your investment as you’re shopping for extra of the asset when prices are low and fewer when costs are high.

Staying Informed

Every element of the crypto sector is new and evolving daily, so it is sensible to method cryptocurrencies with a level of caution in addition to excitement. Between April and June, Bitcoin’s value greater than halved, from simply over $45,000 to round $20,000; different cash have fallen much more. Established corporations like Coinbase, a preferred crypto change, have introduced layoffs.

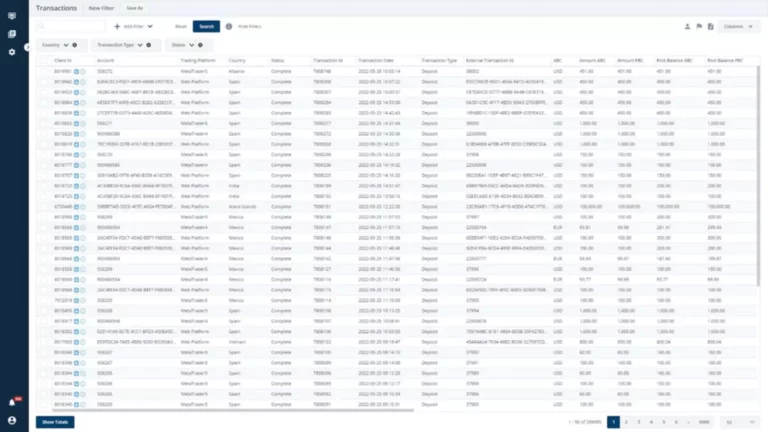

Its conclusion alerts a shift towards normalization post-economic stress, with establishments persevering with to have access to liquidity by way of the discount window. It may also reverberate through the banking sector, with oblique impacts on the liquidity and stability of the crypto market. Bitcoin’s annualized volatility price was eighty one p.c, whereas investors may anticipate on common a 4 p.c change every day. As this infographic shows, these outcomes are half of those of Solana which was revealed to be essentially the most unstable of the currencies checked out within the report.

Yes, there are methods similar to risk administration, staying knowledgeable, and controlling emotions. These strategies help investors capitalize on crypto volatility while mitigating potential dangers. In the ever-evolving world of cryptocurrencies, volatility is a defining attribute that both challenges and rewards investors.

The formation of the Liquidation Committee and the information shared through the meeting may present insights into the fallout from FTX’s collapse and future regulatory scrutiny. The first creditors’ meeting for FTX on March 15 goals to ascertain a Liquidation Committee as part of the official liquidation course of. This meeting is essential for stakeholders to grasp the progress of the liquidation, the claims process, and the influence on the crypto market. It additionally signifies a leap in blockchain expertise, making Ethereum extra accessible and bettering its utility throughout sectors like DeFi. Crypto is a notoriously unstable currency market and one which even catches the experts off guard frequently.

Analyzing the elements which have influenced Bitcoin’s volatility provides useful insights into the broader dynamics of crypto market fluctuations. Those who view Bitcoin volatility as such a large downside that they don’t want to get into cryptocurrencies can chill out. Specifically, there’s one other cryptocurrency asset class that mixes all the professionals of crypto with out the worth volatility. Stablecoins are cryptocurrencies that are tied to a single asset or basket of belongings.

For instance, the Bitcoin Volatility Index tracks the volatility of Bitcoin to USD. One of the most attractive features of crypto market volatility is the potential for prime returns. When costs swing dramatically, savvy traders and merchants can make significant income. For instance, those that bought Bitcoin in its early phases and bought during its peak in late 2017 made huge positive aspects. These can influence the Federal Reserve’s monetary policy choices, affecting investor sentiment towards risk property, including cryptocurrencies.

Due to these factors, cryptocurrencies can expertise significant worth fluctuations, leading to excessive volatility. Cryptocurrency, a digital or virtual form of foreign money, has revolutionized the monetary landscape since the inception of Bitcoin in 2009. The dynamics of the crypto market, pushed by factors corresponding to supply and demand, investor sentiment, and regulatory information, are distinctive and may result in significant value fluctuations. One of the key drivers of cryptocurrency worth volatility is market sentiment. When traders and traders exhibit a positive outlook available on the market, it often will increase demand for cryptocurrencies, pushing their prices upwards. Conversely, pessimistic sentiment can set off a wave of selling, causing costs to plummet.

Those utilizing a US dollar-backed stablecoin, corresponding to USD Coin (USDC) primarily miss out on crypto-specific value volatility. However, stablecoins aren’t protected against the worth volatility of their underlying property. For instance, if the US dollar was to be dramatically devalued from surging inflation, then this would essentially erode the value of USDC compared to different cryptocurrencies. If we assume the cryptocurrency industry will proceed to develop more diversified, crypto volatility could diverge farther from Bitcoin volatility. As the name indicates, Bitcoin volatility technically refers to the value volatility of Bitcoin. On the other hand, crypto volatility may be seen because the overall volatility of the crypto market.

Originally developed for commodities, the ATR indicator may additionally be used to measure the volatility of cryptocurrencies. Crypto assets can function a tool for portfolio diversification as a end result of their worth movements are often uncorrelated with traditional asset classes. However, the excessive volatility of crypto property can even enhance the general threat of a diversified portfolio.

What’s more, it’s based on knowledge from four totally different exchanges; Kraken, Coinbase, Binance, and Gemini. Moreover, the report in query appears at Bitcoin volatility rather than general crypto volatility. It is possible that there’s a growing disconnect between crypto and Bitcoin volatility.